To begin, let's remember how the modern Rolex brand was established.

With good reason, the business philosophies and decisions made by legendary figures like Wilsdorf shape the decisionmaking in Rolex to this day. The logic is clear: Rolex evolved into one of the most valuable brands in history subsequent to Wilsdorf's decision to leave his business to a foundation. There is little reason to doubt that Bucherer will equally strengthen from joining the same foundation.

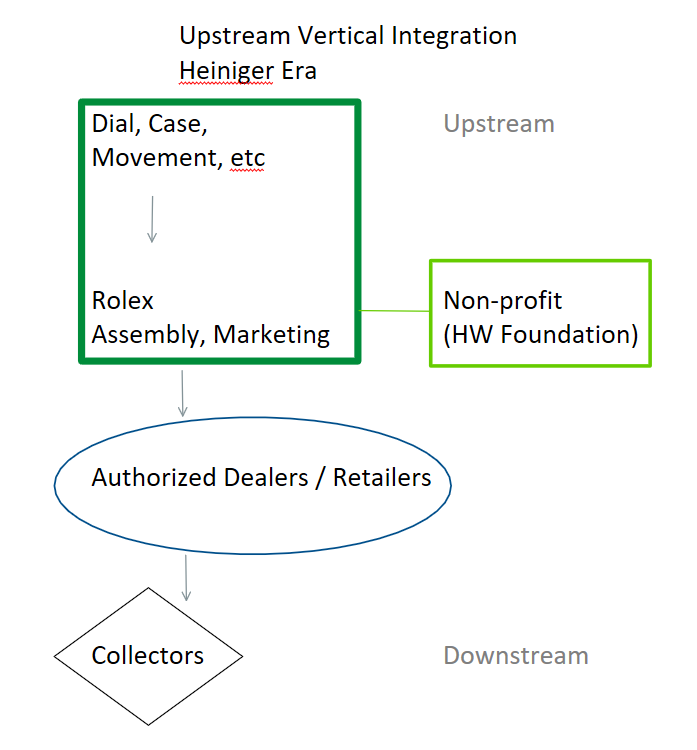

Parts suppliers are the most upstream component of the supply chain (abstracting from raw materials).

There is an open question about whether regulators in Switzerland will raise a barrier to the acquisition. I'm not a betting man, but I wouldn't bet against Rolex. Merger review and regulation is a very complicated economic and legal topic involving reams and reams of publications, court decisions, and the like. A back-of-the-envelope guide, though, is that vertical mergers, involving different steps in the supply chain, typically require the least amount of oversight. For instance, if Rolex sought to buy Swatch Group (a horizontal merger, because both parties make watches), regulators might take a very close look at the plan because it could increase market power and adversely impact collectors. But it is hard to argue that vertical integration, particularly in this case, will adversely impact collectors. Bucherer is one among a very diverse array of channels through which one can buy a watch, particularly when you consider the secondary market. My prediction would be the Bucherer acquisition will be approved, perhaps with some minor conditions.

The great unknown, going forward, is the extent to which Rolex begins to allocate more and more of its production to distribution through Bucherer, leaving less and less for other incumbent authorized dealers. I believe this is extremely likely. There are many reasons. First, Rolex will be able to control, more extensively, the buyer experience at Bucherer and more continuously train sales staff. The brand will also be able to more quickly pivot and adjust the buying experience. Second, there have been two somewhat high-profile scandals at authorized dealers recently. One took place at C. D. Peacock in Chicago. Employees allege that new watches were shunted to the grey market, rather than actual collectors, presumably so that someone could earn more on sales. The second high profile scandal took place at a Patek autorized dealer in San Francisco, when a collector spent more than $200,000 on less-preferred merchandise in order to gain access to a Nautilus, which was the watch he actually wanted. The dealer involved lost their distribution agreement with Patek before the collector could buy the Nautilus, so the collector sued. Every brand would naturally like to eliminate any reputational harm from these types of dealer shenanigans. If Rolex channels more of their sales through a retailer they control, they minimize their exposure to reputational risk.

More generally, Rolex often plays the role of an "anchor" brand in stores selling other watch brands and / or jewelry. In American retail, malls often have a number of prominent stores that would serve as a "draw" for visitors. This means that smaller stores benefit from the presence of an anchor store since buyers visiting a large store, like Macys, maybe decide to drop in and spend money at smaller stores. Sometimes this is also described as a "halo" effect.

In multibrand stores, Rolex undoubtedly serves as a draw for buyers. And, "buying history" allows a client to take priority when it comes to acquiring a hard-to-find Rolex. For example, a client who buys 10 Breitlings, spending perhaps $80,000 in a multibrand boutique, may get access to a new Tiffany blue dial Datejust before other people. If Rolex does not like this practice, it can put an end to it in Bucherer stores. Or, it could prioritize access based upon purchases of Rolex and / or Tudor, thereby limiting the ability of other brands to ride the coat-tails of Rolex's reputation.

There is one clear financial downside from a pivot towards Bucherer as Rolex's preferred distributor. A sometimes-overlooked revenue stream for Rolex comes through their subsidiary Roldeco (think "Rolex" "Decorations"). When you visit a Rolex AD, you will see Roldeco products by way of decorations on the walls, on displays and all around the Rolex portion of the sales floor. These products are sold to ADs by Rolex via Roldeco. If Rolex does decide to shrink their distribution through independent ADs, it is likely they will find less revenue via Roldeco.

The amount of this revenue is not publicly known, so the magnitude of any possible loss from reduced Roldeco business is difficult to ascertain. It is worth noting, though, that Rolex has another option when it comes to reallocating inventory away from existing ADs and towards Bucherer. The brand could expand the presence of Tudor in non-Bucherer authorized dealers while Rolex shrinks, thereby maintaining a robust relationship with existing dealers. Roldeco business would then increase as newly redesigned Tudor sales floors are introduced.

The only people who know exactly what will happen probably aren't talking very much. Traders on the London stock market have placed bets on the future, though. When news broke about Rolex's plan to vertically integrate downstream into retail, the stock price of one authorized dealer plummeted. Watches of Switzerland shares dropped by approximately 25%, suggesting financial prospects had dimmed, at least in perception if not in reality. It could well be the case that traditional authorized dealers are able to maintain their relationships with Rolex. There is one thing we can state with confidence though. Between the bold Puzzle and Celebration dial releases this year, the announcement of Rolex's entry into certified pre-owned, and now this acquisition of Bucherer, we can not doubt that we now live in the Dufour era of the brand.

My book on the history of Rolex marketing is now available on Amazon! It debuted as the #1 New Release in its category. You can find it here.

You can subscribe to Horolonomics updates here.

Comments

Post a Comment